Today, as global stock markets continue to fall and fears of a global recession deepen, finance ministers from the Group of Seven (G7) are meeting in Washington in advance of IMF and World Bank meetings tomorrow. These ministers from the United States, Canada, Britain, France, Germany, Italy and Japan are expected to address the current global financial crisis. Many policy makers and central bankers around the world originally viewed the mortgage meltdown primarily as an American problem with secondary ripple effects in Europe. But the interconnectedness of the world financial markets soon brought this crisis to markets in Europe and Asia, requiring a coordinated international response. This is a global problem, and it will require a global solution.

Indonesia will not immediately reap great benefits from the commitment made by the leaders of the world’s 20 largest and emerging economies (G-20) — including Indonesia’s President Susilo Bambang Yudhoyono — at their summit in Washington over the weekend to launch coordinated fiscal and monetary measures to counter the global economic slowdown.

But their determination to enhance cooperation to restore global growth, achieve badly needed reforms in the financial systems and give more say to emerging economies in global economic policy making would be a confidence-building block in the effort to curb wild financial volatility.

This new mechanism of international economic cooperation has yet to be deliberated at their next gathering scheduled for April but this is already a good signal for similar reforms within the decision- and policy-making processes at the International Monetary Fund and World Bank.

Yet most promising is the leaders’ strong commitments to reform the governance of the financial system — including the banking industry — and to provide joint economic stimulus to mitigate the effects of the deepening global downturn as the recession has spread from the United States to Europe and Japan.

This and similar commitments by the central bankers around the world to ease credit strains and support faltering economic growth would be a boost to further global cooperation in coping with the financial crisis and economic slowdown.

However, Asia should support the promises by the G-20 leaders with its own coordinated policies in monetary, fiscal and exchange rate areas to ensure financial market stability for macroeconomic management. This is where Japan, China, South Korea and ASEAN should show leadership.

The leaders of these leading Asian economies should bring to the next G-20 meeting a coordinated Asian macroeconomic policy framework since economic expansion in Asia will not only help to sustain Asia’s own economic growth and employment levels but also will also help to put a floor on the coming global slowdown.

Trade-wise, higher growth in Asia will also mean more sales of U.S. goods in Asian markets, thereby helping to moderate the U.S. and European recessions as well. For this reason, coordinated macroeconomic expansion among China, Japan, and Korea will be highly appreciated in all other parts of the world.

A few days before the G-20 summit, the World Bank and IMF came up with a grimmer economic outlook for next year, projecting an economic contraction of 0.1 percent for the advanced economies and a growth of only 4.5 percent for developing countries. Global trade, which grew by 9.8 percent in 2006, is projected to fall in 2009 for the first time since 1982.

The strongest message from the G-20 summit which is most relevant to Indonesia is the need to provide strong fiscal stimulus and rescue packages. As the international financial condition has now become much tighter, with capital flight leading to sharp falls in equity markets and steep rises in government and corporate bond spreads, the government needs to provide most of the pump-priming force. Aggregate demand needs to be sustained by fiscal policy.

This is the momentum for both the public and private sector to better coordinate measures to facilitate basic infrastructure development which needs little foreign exchange financing.

However, fiscal stimulus alone is not enough. It should receive strong support from an easier monetary policy, especially since inflationary pressures have weakened due to the combination of lower import prices and falling demand.

But again an easier monetary policy without significant improvement in the business or overall investment environment could provide more ammunition for foreign exchange speculation against the rupiah.

We suspect that the estimated Rp 50-70 trillion (US$4.5-6.3 billion) in additional liquidity made available by the lowering of the minimum reserve requirement at commercial banks last month to 7.5 percent from 9.5 percent (of deposits) played a part in the latest wave of speculative attacks on the rupiah over the last two weeks.

Kamis, 15 Januari 2009

Sabtu, 13 Desember 2008

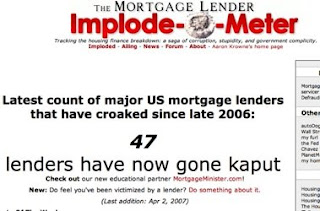

Subprime Mortgage Lenders Implode-o-meter

The misery in the housing market is registering on the Implode-O-Meter. As millions of homeowners fall behind on their mortgages, a fledging Web site called the Mortgage Lender Implode-O-Meter is gleefully tallying the number of lenders that run into trouble too.

Mortgage Lenders Implode-o-meter.Did you hear about this? There is a forum group that keeps track of which mortgage companies have gone belly-up, out of biz....called Implode-o-meter. They also monitor those lending companies that are on trembling ground....referred to as Ailing/Watch list Lenders. Notably on that watch list is Sallie Mae, a company that bills itself as the nation's leading provider of student loans. (They're not expected to implode, but start paying your student loans off people....so the next generation can get an education!)

Implode-o-meter is an independent source/website who state their standards are more concerned with content, not reputation or resources. But you can bet everyone in the lending business is watching this website. And if you've got a mortgage or are in the loan process you should be watching this list too....and perhaps read the forum comments.

Sabtu, 06 Desember 2008

Big Three Bail Out : Ford, GM, Chrysler

US big three : Ford, Gm, and Chrysler are the biggest auto company, with the long lasted history. But now this Detroit's Big Three automakers returned today to Capitol Hill to take another stab at getting $34 billion dollars of your money. Yes, this big three are getting a serious problem, near to bankrupt.

It is still hard for US White house to approve this big three big deal. How come the big company like GM, Ford, and Chrsyler are begging for bailout ?

Washington is engaged in a giant game of chicken with the Big Three automakers, and unless someone swerves soon, Detroit is going to end up as wreckage on the side of the road.

In their first day of testimony before Congress, the chief executives of Ford, General Motors and Chrysler were the picture of humility. Hats in hand, they pleaded for money. "We made mistakes, which we're learning from," GM's Rick Wagoner told the Senate Banking Committee, outlining plans for change that Congress had requested as a precondition for receiving billions of dollars in much needed loans. Ford's Alan Mulally said his company has shifted "in a completely new direction." (See the 50 worst cars of all time.)

Unlike the hearings last month, though, when Congress presented a nearly united, hostile front against the Big Three, the fight Thursday was not so much over whether Washington should let them fail; almost all the witnesses and lawmakers agreed that would be like "playing Russian roulette with the economy," as Senate Banking Committee Chairman Chris Dodd put it. But that didn't mean there was anything like a consensus on how to handle the urgent request for a total of $34 billion in bridge loans — $7 billion for Chrysler, $9 billion for Ford and $18 billion for GM. Democrats and Republicans clearly still have major disagreements about where the money should come from, how much Detroit should get up-front and what kind of conditions to impose for such government assistance.

From left, Richard Wagoner, chief executive of General Motors, Robert L. Nardelli, chief executive of Chrysler, Alan R. Mulally, chief executive of Ford, and Ron Gettelfinger, head of the United Automobile Workers, during a House hearing on Friday.

It is still hard for US White house to approve this big three big deal. How come the big company like GM, Ford, and Chrsyler are begging for bailout ?

Washington is engaged in a giant game of chicken with the Big Three automakers, and unless someone swerves soon, Detroit is going to end up as wreckage on the side of the road.

In their first day of testimony before Congress, the chief executives of Ford, General Motors and Chrysler were the picture of humility. Hats in hand, they pleaded for money. "We made mistakes, which we're learning from," GM's Rick Wagoner told the Senate Banking Committee, outlining plans for change that Congress had requested as a precondition for receiving billions of dollars in much needed loans. Ford's Alan Mulally said his company has shifted "in a completely new direction." (See the 50 worst cars of all time.)

Unlike the hearings last month, though, when Congress presented a nearly united, hostile front against the Big Three, the fight Thursday was not so much over whether Washington should let them fail; almost all the witnesses and lawmakers agreed that would be like "playing Russian roulette with the economy," as Senate Banking Committee Chairman Chris Dodd put it. But that didn't mean there was anything like a consensus on how to handle the urgent request for a total of $34 billion in bridge loans — $7 billion for Chrysler, $9 billion for Ford and $18 billion for GM. Democrats and Republicans clearly still have major disagreements about where the money should come from, how much Detroit should get up-front and what kind of conditions to impose for such government assistance.

From left, Richard Wagoner, chief executive of General Motors, Robert L. Nardelli, chief executive of Chrysler, Alan R. Mulally, chief executive of Ford, and Ron Gettelfinger, head of the United Automobile Workers, during a House hearing on Friday.

Rabu, 19 November 2008

CitiBank to lay off and fire 10.000 workers

Citibank is a major international bank, founded in 1812 as the City Bank of New York, later First National City Bank of New York. Citibank is now the consumer and corporate banking arm of financial services giant Citigroup, one of the largest companies in the world. As of March 2007, it is the largest bank in the United States by holdings

Citibank has operations in more than 100 countries and territories around the world. More than half of its 1,400 offices are in the United States, mostly in the New York City, Chicago, Miami, and Washington DC metropolitan areas, as well as in California.

Citigroup (C) plans to lay off and fire at least 10,000 people starting this week and to raise interest rates on millions of its credit-card customers, The Wall Street Journal reported Friday, citing people familiar with the matter.

Executives have told officials to slash their compensation budgets by 25%, the Journal said.

In addition, Citibank is going to announce steep increases in the credit card interest rates and I’m sure we’ll also see higher credit card fees as well. The goal will be to place more “innocent” land mines in front of consumers that they can step on to increase revenue for Citibank.

Consumers can opt out of the rate increase, the Journal said, and will be able to use their credit cards until their expiration. This follows a similar move by American Express

(AXP).

The Journal also mentioned that Citigroup called “completely erroneous” its report that the firm was considering replacing Sir Win Bischoff as chairman, but it said it stood by the article and that people familiar with the matter said the move was still being considered.

Selasa, 11 November 2008

American Express to Be Bank Holding Company

American Express (NYSE: AXP), sometimes known as "AmEx" or "Amex", is a diversified global financial services company, headquartered in New York City. The company also has major offices in Fort Lauderdale, Florida; Salt Lake City, Utah; Greensboro, North Carolina; and Phoenix, Arizona. The company is best known for its credit card, charge card, and traveler's cheque businesses.

American Express agreed to Be Bank Holding Company

American Express announced today that the U.S. Federal Reserve has approved its application to become licensed as a bank holding company and to be regulated by the Federal Reserve.

Qualifying as a bank holding company will provide American Express maximum flexibility and stability in this challenging economic environment. It aligns American Express' regulatory status with other companies in the financial services industry, further diversifies the Company's funding sources and access to capital, and provides opportunities to expand its deposit-taking capabilities.

American Express had already operated a commercial bank and a savings bank supervised by federal regulators. But the bulk of its assets were not in those institutions. As a bank holding company, these assets are now under federal supervision, a move that expands the amount of financing it can request from the government. That means the bank could qualify for up to $3.6 billion of the Treasury Department’s money, instead of just a small portion.

His announcement came as American Express reported a 24 percent drop in third-quarter profit and said it would slash 10 percent of its work force as it prepared to write off a larger pool of credit card loans. American Express wrote off about 5.9 percent of these loans in the third quarter.

Selasa, 04 November 2008

How Barack Obama to cure Subprime Mortgage Crisis

US citizens will face their election on 4th November 2008. Who will become the president? Barack Obama or John McCain ? Who will be elected, one thing sure to do is to solve the US Economy, including the subprime mortgage crisis.

What did Obama do to help create the subprime debacle? Well, Obama joined with a group of other Chicago lawyers who bullied and threatened area banks to loan money to poor minorities who couldn’t afford the mortgages.

Barack H. Obama is running around telling everyone that the housing mortgage market collapsed primarily because of some vaguely described “deregulation” that took place sometime under George Bush–or maybe under Clinton; I’m not clear on that. I’m not sure he is.

Whatever his claim is, it’s a lie.

The reality is that the housing market collapsed in large part because a coalition of race-baiting bullies brought very heavy pressure to bear on the banks to make more subprime loans on properties in low-income communities. Those who didn’t approve the risky subprime loans were accused of “redlining”–i.e., refusing to make loans on properties in those neighborhoods.

Who were these bullies?

Some of the bullies were out in Washington pounding the tables and screaming at bank executives about “redlining”.

At the same time, other bullies were stalking big city courthouses, filing frivolous and extortinate lawsuits against banks based on novel “disparate impact” theories of what might be held to constitute “redlining.” In other words, even banks which were making lots of loans in low-income communities were being sued if they weren’t approving just as many loans in low-income communities as they were in high-income communities.

Here is a short video from Democratic presidential candidate Barack Obama in which he promises to create a ten million dollar fund to help keep people in their homes and a tax deduction for homeowners who do not itemize on their income tax returns.

What did Obama do to help create the subprime debacle? Well, Obama joined with a group of other Chicago lawyers who bullied and threatened area banks to loan money to poor minorities who couldn’t afford the mortgages.

Barack H. Obama is running around telling everyone that the housing mortgage market collapsed primarily because of some vaguely described “deregulation” that took place sometime under George Bush–or maybe under Clinton; I’m not clear on that. I’m not sure he is.

Whatever his claim is, it’s a lie.

The reality is that the housing market collapsed in large part because a coalition of race-baiting bullies brought very heavy pressure to bear on the banks to make more subprime loans on properties in low-income communities. Those who didn’t approve the risky subprime loans were accused of “redlining”–i.e., refusing to make loans on properties in those neighborhoods.

Who were these bullies?

Some of the bullies were out in Washington pounding the tables and screaming at bank executives about “redlining”.

At the same time, other bullies were stalking big city courthouses, filing frivolous and extortinate lawsuits against banks based on novel “disparate impact” theories of what might be held to constitute “redlining.” In other words, even banks which were making lots of loans in low-income communities were being sued if they weren’t approving just as many loans in low-income communities as they were in high-income communities.

Here is a short video from Democratic presidential candidate Barack Obama in which he promises to create a ten million dollar fund to help keep people in their homes and a tax deduction for homeowners who do not itemize on their income tax returns.

Rabu, 29 Oktober 2008

Things that You Never Want To Tell A Mortgage Company

Yes it is important to be honest when speaking to a mortgage company, however when you are starting or in negotiations with a mortgage lender in an attempt to stop or delay a home foreclosure there are some facts that you should never tell your mortgage company.

Personal Finances

Never discuss your household finances over the phone with the collection department. What you don’t know is that you are being qualified and not know it. This is the easiest and fastest way to get a turn down. Request a homeowners assistance package so that you can submit the require information.

Cash Flow

Never tell them you are broke. Even though you may qualify for a special forbearance or modification, you will still need legal fees and foreclosure cost. These fees cannot be put back into the loan. Your lender prepaid them to their attorney to start the foreclosure process.

Not Living In The Property

Never tell them you do not live in the property. Under FHA guidelines, before you are granted any workout, you must reside in the property. If you have moved out and your property became an investment property, you better get someone in there with a lease or rental contract before the sale date.

Employment Status

Never tell them you are not working, in most cases you will not be approved. Depending on your sale date, your mortgage lender may not be able to qualify you for a special forbearance because of the amount of time left. If you can’t find a job, I suggest you start a small business months before your sale date, make some money, deposit your income and prepare a Profit and Loss Statement to prove income. Telling them you get paid cash and you can’t prove it won’t hold water.

Money Management

Never admit the reason you fell behind is because you mismanaged your money. How do you expect for them to give you a workout when you still have the potential of falling behind again?

It is important to be honest with a mortgage lender, it is also imperative that when speaking of personal financial details you are giving such sensitive information to the correct department and person.

The manner in which your personal information may be used to either help or hinder your efforts to stop foreclosure is not always used in the same way.

If you are behind on the mortgage or the lender is starting foreclosure proceedings now is the time to act, and I mean act fast. Educate yourself on what the foreclosure process is and how it will progress. Learn who you need to talk to and in what order you should contact them. What other options are available instead of simply allowing the lender to foreclose and sell your home. Check out The Foreclosure Survival Handbook for answers to all these situations.

Langganan:

Komentar (Atom)